Global Cell and Gene Therapy Manufacturing Market to Reach ~USD 10 Billion by 2032 | DelveInsight

The growing incidence of genetic disorders and chronic illnesses, including cancer and rare inherited conditions, is fueling the demand for advanced therapies, highlighting the need for strong manufacturing capabilities. At the same time, the swift expansion of the cell and gene therapy pipeline, with many treatments progressing through clinical trials, is driving the need for scalable and efficient production solutions.

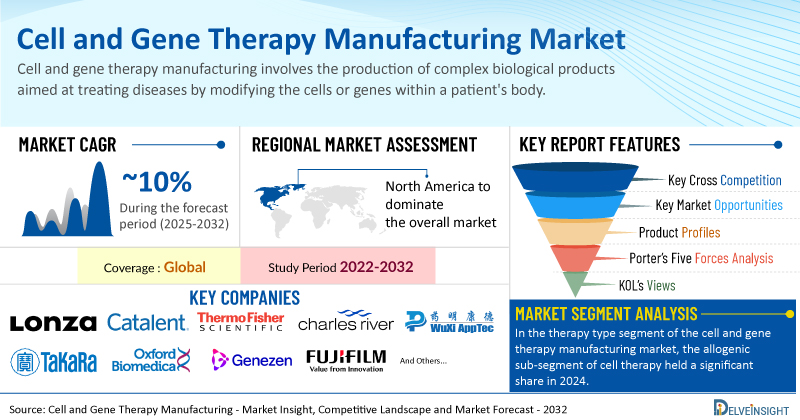

/EIN News/ -- New York, USA, March 05, 2025 (GLOBE NEWSWIRE) -- Global Cell and Gene Therapy Manufacturing Market to Reach ~USD 10 Billion by 2032 | DelveInsight

The growing incidence of genetic disorders and chronic illnesses, including cancer and rare inherited conditions, is fueling the demand for advanced therapies, highlighting the need for strong manufacturing capabilities. At the same time, the swift expansion of the cell and gene therapy pipeline, with many treatments progressing through clinical trials, is driving the need for scalable and efficient production solutions.

DelveInsight’s Cell and Gene Therapy Manufacturing Market Insights report provides the current and forecast market analysis, individual leading cell and gene therapy manufacturing companies’ market shares, challenges, cell and gene therapy manufacturing market drivers, barriers, trends, and key market cell and gene therapy manufacturing companies in the market.

Key Takeaways from the Cell and Gene Therapy Manufacturing Market Report

- As per DelveInsight estimates, North America is anticipated to dominate the global cell and gene therapy manufacturing market during the forecast period.

- In the therapy type segment of the cell and gene therapy manufacturing market, the allogenic sub-segment of cell therapy held a significant share in 2024.

- Notable cell and gene therapy manufacturing companies such as Lonza, Catalent, Inc., Thermo Fisher Scientific, Inc., Charles River Laboratories, WuXi AppTec, Merck KGaA, Takara Bio Inc., Oxford Biomedica PLC, Genezen, FUJIFILM Holdings Corporation, Nikon Corporation, The Discovery Labs LLC, RoslinCT, JRS Pharma, FinVector, Sarepta Therapeutics, Inc., BioCentriq, Andelyn Biosciences, ElevateBio, Anemocyte Srl, and several others, are currently operating in the cell and gene therapy manufacturing market.

- In October 2024, Xcell Biosciences Inc. strengthened its partnership with AmplifyBio, a fast-growing contract development and manufacturing organization, by installing a new AVATAR™ Foundry system as part of Xcellbio’s beta access program. This addition will allow AmplifyBio’s team to transition from small-scale workflows on the previously implemented AVATAR™ Odyssey platform to automated cell therapy manufacturing processes designed for clinical applications.

- In September 2024, ScaleReady and Bio-Techne Corporation introduced the G-Rex optimized ProPak™ GMP Cytokines, specifically designed for efficient, closed-system manufacturing of cell and gene-modified cell therapies (CGT).

- In December 2023, the FDA approved CASGEVY and LYFGENIA the first cell-based gene therapy for treating sickle cell disease (SCD) in patients aged 12 years and older.

- In June 2023, Sarepta Therapeutics, Inc. received accelerated approval from the U.S. FDA for ELEVIDYS (delandistrogene moxeparvovec-rokl), a gene therapy designed to treat ambulatory pediatric patients aged 4 to 5 years with Duchenne muscular dystrophy (DMD) who have a confirmed mutation in the DMD gene.

- In March 2023, Thermo Fisher Scientific and Arsenal Biosciences formed a collaboration to support the clinical manufacturing of autologous T-cell therapies.

To read more about the latest highlights related to the cell and gene therapy manufacturing market, get a snapshot of the key highlights entailed in the Global Cell and Gene Therapy Manufacturing Market Report

Cell and Gene Therapy Manufacturing Overview

Cell and gene therapy manufacturing involves the production of complex biological products aimed at treating diseases by modifying the cells or genes within a patient's body. This process typically includes the collection of patient cells, which are then genetically altered, expanded, and reintroduced into the patient to either replace dysfunctional cells or correct genetic mutations. Manufacturing these therapies is highly intricate and requires strict adherence to Good Manufacturing Practices (GMP) to ensure safety, efficacy, and consistency. The production process is customized for each patient or batch, which adds a layer of complexity when compared to traditional pharmaceutical manufacturing.

The scale-up and automation of cell and gene therapy manufacturing are ongoing challenges, given the unique nature of each therapy and the need for personalized treatment plans. These therapies also require sophisticated equipment and facilities to maintain the viability and functionality of the cells or genetic material during processing. Additionally, there is a strong emphasis on quality control, tracking, and traceability to meet regulatory standards. As these therapies evolve, so does the need for improved manufacturing technologies to enhance scalability, reduce costs, and ensure faster turnaround times without compromising on product quality.

Cell and Gene Therapy Manufacturing Market Insights

North America is anticipated to dominate the cell and gene therapy manufacturing market in the coming years. This leadership is driven by the region’s strong presence of major biopharmaceutical companies, well-established healthcare infrastructure, and a supportive regulatory framework. The U.S. Food and Drug Administration (FDA) plays a crucial role in accelerating the development and commercialization of advanced therapies through initiatives such as fast-track designations, breakthrough therapy designations, and orphan drug approvals. Additionally, significant investments from government agencies and private entities are strengthening manufacturing capabilities and fostering innovation.

The growing prevalence of chronic diseases and genetic disorders is further fueling market demand, with hemophilia remaining a key focus area for gene therapy advancements. Transformative treatments such as BioMarin’s ROCTAVIAN for hemophilia A and CSL Behring’s HEMGENIX for hemophilia B have redefined patient care by enabling sustained clotting factor production with a single administration. This shift toward curative solutions over conventional therapies, like frequent factor replacement, is driving the need for large-scale production of viral vectors and other critical components.

Regulatory approvals continue to stimulate market expansion. In December 2023, the FDA approved CASGEVY and LYFGENIA, the first cell-based gene therapies for sickle cell disease in patients aged 12 and older. By addressing the root cause of SCD through hemoglobin gene correction, these treatments offer the potential for long-term remission and reduced reliance on symptomatic management approaches such as blood transfusions. Such approvals highlight North America's leading role in advancing innovative therapies.

Moreover, high patient awareness in the region facilitates the rapid adoption of new treatments. Collaborative efforts between biopharmaceutical companies, CMOs, and academic institutions are further accelerating process development and scaling capabilities. Technological advancements in automation, bioprocessing, and supply chain management are enhancing production efficiency and ensuring timely patient access to therapies.

Overall, factors such as increasing disease prevalence, regulatory support, technological progress, and strategic industry initiatives are expected to drive substantial growth in North America's cell and gene therapy manufacturing market from 2025 to 2032.

To know more about why North America is leading the market growth in the cell and gene therapy manufacturing market, get a snapshot of the Cell and Gene Therapy Manufacturing Market Outlook

Cell and Gene Therapy Manufacturing Market Dynamics

The cell and gene therapy manufacturing market is undergoing rapid transformation, driven by increasing demand for personalized medicine, advancements in bioprocessing technologies, and regulatory changes. With groundbreaking therapies like CAR-T cell treatments and gene-editing technologies (such as CRISPR), the industry is shifting from traditional batch processing to more scalable and automated solutions. However, challenges such as high costs, complex supply chains, and stringent regulatory requirements continue to impact market growth and scalability.

One of the most significant dynamics in CGT manufacturing is the shift toward automation and digitalization. Traditional manual processes are being replaced by closed, automated systems that improve consistency, reduce contamination risks, and enhance scalability. Companies are investing in advanced bioreactors, single-use systems, and AI-driven process analytics to streamline production. Additionally, digital twin technologies and real-time monitoring are improving quality control, reducing batch failures, and optimizing yield.

The supply chain complexity remains a major bottleneck in CGT manufacturing. Unlike traditional biologics, CGT products often require personalized or small-batch production, leading to logistical challenges in sourcing raw materials, managing cold-chain storage, and ensuring timely delivery. The industry is witnessing an increasing push for localized manufacturing hubs and decentralized production models to mitigate these challenges. Strategic collaborations between biotech firms, CDMOs (contract development and manufacturing organizations), and logistics providers are helping to address these issues.

Regulatory agencies, including the FDA and EMA, are playing a crucial role in shaping the CGT manufacturing landscape. Accelerated approvals and regulatory frameworks for CGT products, such as the FDA's RMAT designation, are expediting market entry. However, manufacturers must adhere to evolving GMP guidelines, including stringent sterility requirements and robust analytical characterization of therapies. Continuous engagement with regulatory bodies is crucial to navigating these complexities.

Looking ahead, cost reduction and scalability will be key focus areas for the CGT manufacturing market. Advances in allogeneic (off-the-shelf) therapies, improved vector production techniques, and continuous bioprocessing methods are expected to drive efficiencies. Additionally, increasing investment in AI-driven manufacturing and end-to-end automation will further enhance process robustness. As more therapies transition from clinical trials to commercialization, the demand for innovative manufacturing solutions will continue to rise, making CGT production more accessible and cost-effective.

Get a sneak peek at the cell and gene therapy manufacturing market dynamics @ Cell and Gene Therapy Manufacturing Market Dynamics Analysis

| Report Metrics | Details |

| Coverage | Global |

| Study Period | 2022–2032 |

| Cell and Gene Therapy Manufacturing Market CAGR | ~10% |

| Cell and Gene Therapy Manufacturing Market Size by 2032 | ~USD 10 Billion |

| Key Cell and Gene Therapy Manufacturing Companies | Lonza, Catalent, Inc., Thermo Fisher Scientific, Inc., Charles River Laboratories, WuXi AppTec, Merck KGaA, Takara Bio Inc., Oxford Biomedica PLC, Genezen, FUJIFILM Holdings Corporation, Nikon Corporation, The Discovery Labs LLC, RoslinCT, JRS Pharma, FinVector, Sarepta Therapeutics, Inc., BioCentriq, Andelyn Biosciences, ElevateBio, Anemocyte Srl, among others |

Cell and Gene Therapy Manufacturing Market Assessment

-

Cell and Gene Therapy Manufacturing Market Segmentation

- Cell and Gene Therapy Manufacturing Market Segmentation By Product Type: Antibiotics, Probiotics, Monoclonal Antibodies, Biosimilar, Recombinant Proteins & Vaccines, Enzymes, and Others

- Cell and Gene Therapy Manufacturing Market Segmentation By End-User: Pharmaceutical & Biotechnology Industry, Contract Research Organizations (CROs), CMOs & CDMOs, and Academic & Research Institutions

- Cell and Gene Therapy Manufacturing Market Segmentation By Geography: North America, Europe, Asia-Pacific, and Rest of World

- Porter’s Five Forces Analysis, Product Profiles, Case Studies, KOL’s Views, Analyst’s View

Which MedTech key players in the cell and gene therapy manufacturing market are set to emerge as the trendsetter explore @ Cell and Gene Therapy Manufacturing Companies

Table of Contents

| 1 | Cell and Gene Therapy Manufacturing Market Report Introduction |

| 2 | Cell and Gene Therapy Manufacturing Market Executive Summary |

| 3 | Competitive Landscape |

| 4 | Regulatory Analysis |

| 5 | Cell and Gene Therapy Manufacturing Market Key Factors Analysis |

| 6 | Cell and Gene Therapy Manufacturing Market Porter’s Five Forces Analysis |

| 7 | Cell and Gene Therapy Manufacturing Market Layout |

| 8 | Cell and Gene Therapy Manufacturing Market Company and Product Profiles |

| 9 | KOL Views |

| 10 | Project Approach |

| 11 | About DelveInsight |

| 12 | Disclaimer & Contact Us |

Interested in knowing the cell and gene therapy manufacturing market by 2032? Click to get a snapshot of the Cell and Gene Therapy Manufacturing Market Trends

Related Reports

Gene Therapy Competitive Landscape

Gene Therapy Competitive Landscape – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key gene therapy companies, including Novartis, Johnson & Johnson, Fibrocell Technologies, Pfizer, HELIXMITH Co., Ltd., Sarepta Therapeutics, REGENXBIO, Solid Biosciences Inc., Lexeo Therapeutics, Spark Therapeutics, Xalud Therapeutics, uniQure, Ultragenyx Pharmaceutical, Nanoscope Therapeutics, among others.

Gene Therapy Market Insight, Competitive Landscape, and Market Forecast – 2032 report delivers an in-depth understanding of market trends, market drivers, market barriers, and key healthcare IT consulting companies, including Abiomed, Inc., Asahi Kasei Corporation, Abbott Laboratories, Berlin Heart GmbH, Jarvik Heart, Inc., Medtronic Plc., Terumo Corporation, Evaheart, Inc., Calon Cardio, SynCardia Systems LLC, Cardiobridge Gmbhand, LivaNova, Inc., Cirtec, CorWave SA, FineHeart, ReliantHeart Inc., among others.

Adeno-Associated Virus Vectors in Gene Therapy Pipeline

Adeno-Associated Virus Vectors in Gene Therapy Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key adeno-associated virus vectors in gene therapy companies, including Pfizer, CSL Behring, Spark Therapeutics, Freeline Therapeutics, RegenxBio, Amicus Therapeutics, among others.

Adeno-Associated Virus Vectors in Gene Therapy Market

Adeno-Associated Virus Vectors in Gene Therapy Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key adeno-associated virus vectors in gene therapy companies, including Pfizer, CSL Behring, Spark Therapeutics, Freeline Therapeutics, RegenxBio, Amicus Therapeutics, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant, and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance.

Contact Us

Shruti Thakur

info@delveinsight.com

+14699457679

Distribution channels: Healthcare & Pharmaceuticals Industry, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release